Fha title 1 loan calculator

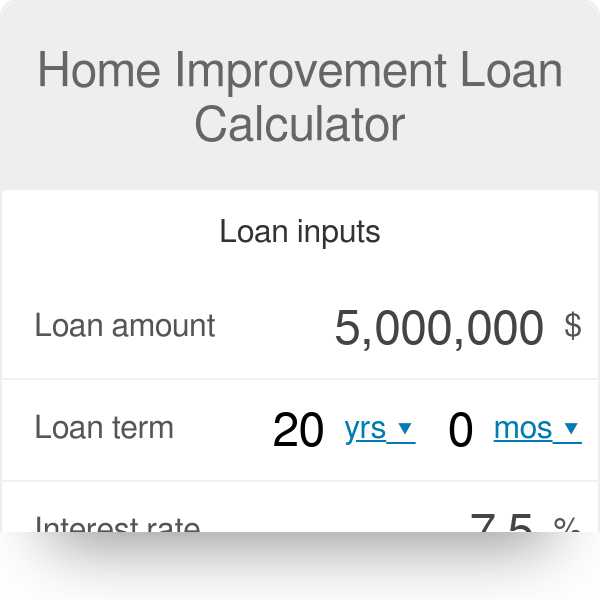

The term of the loan can affect the structure of the loan in many ways. Many people who can afford the.

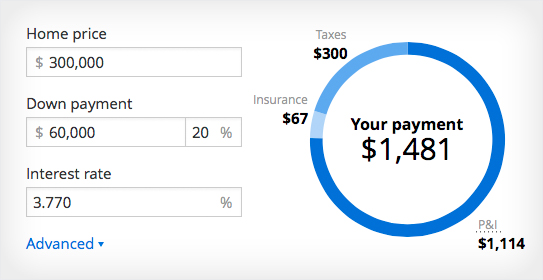

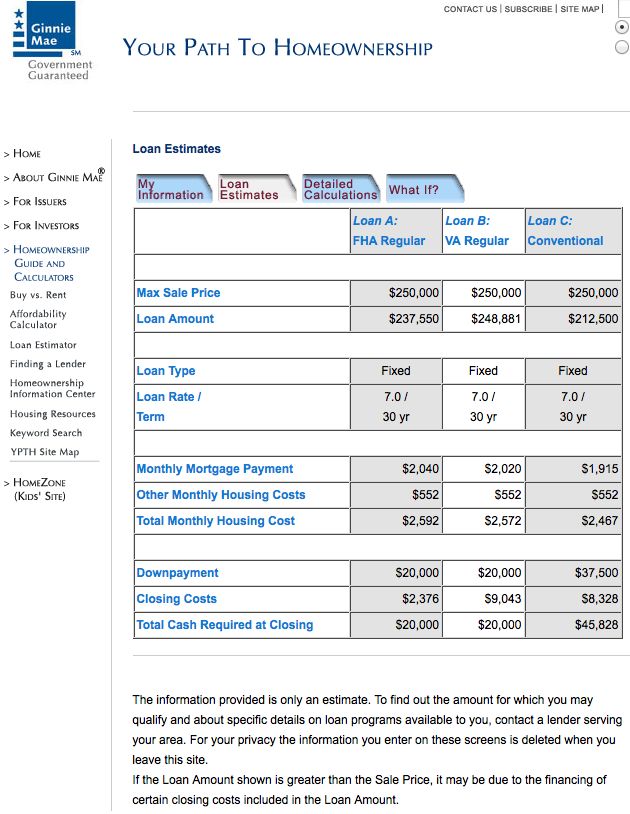

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Mortgage loan basics Basic concepts and legal regulation.

. FHA loans are the 1 loan type in America. Sep 1 California lawmakers OK bills to curtail social media The online world has created tremendous opportunities but also real and proximate threats said one legislator. FHA loan income requirements.

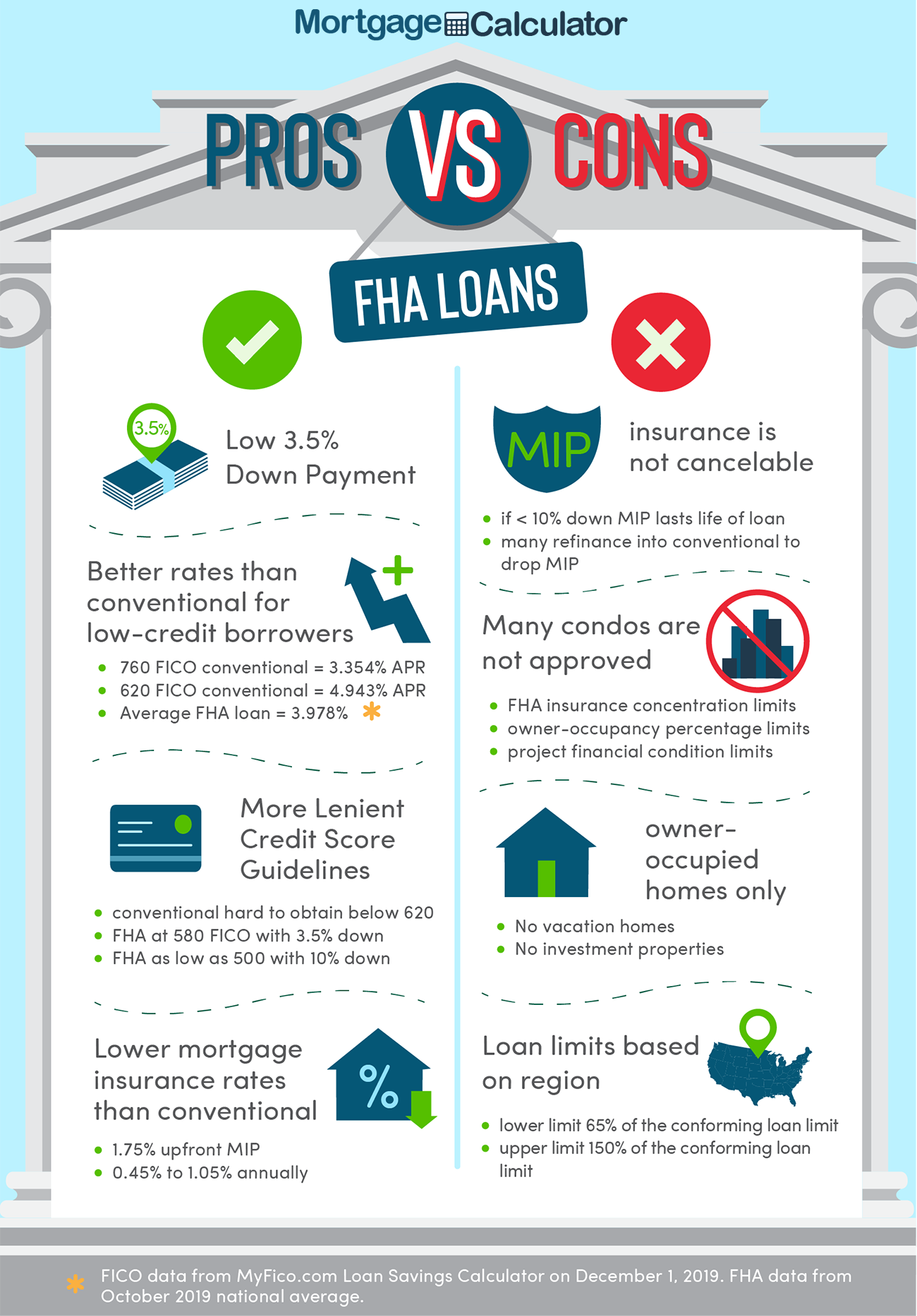

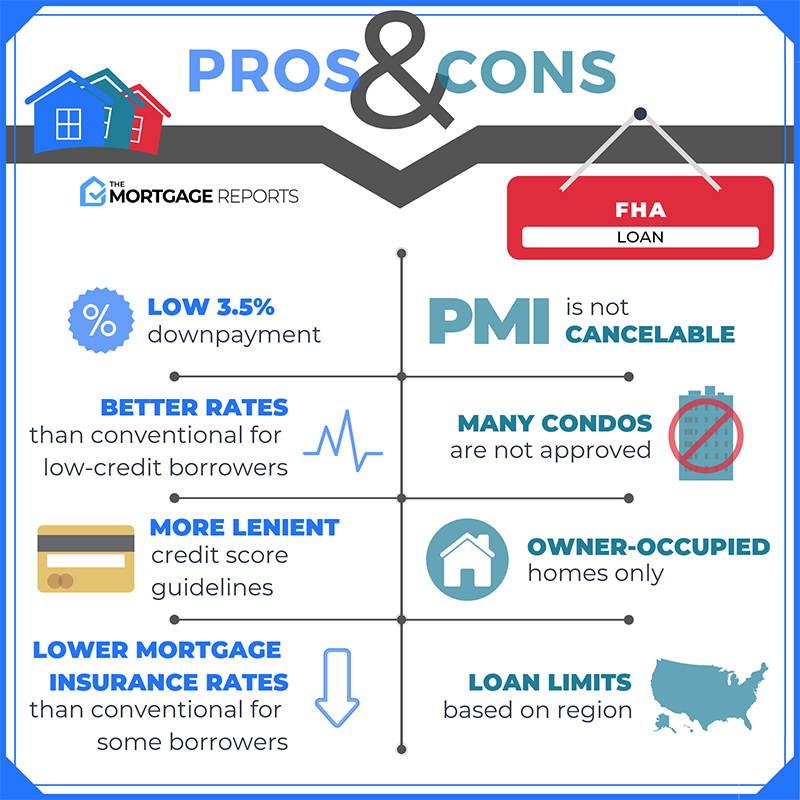

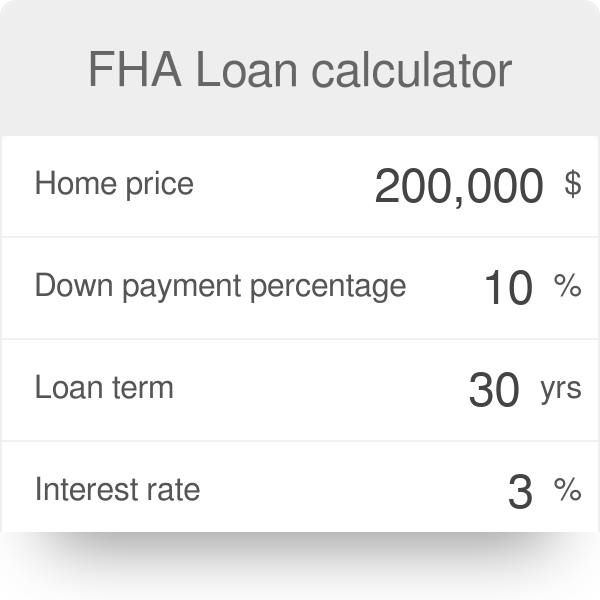

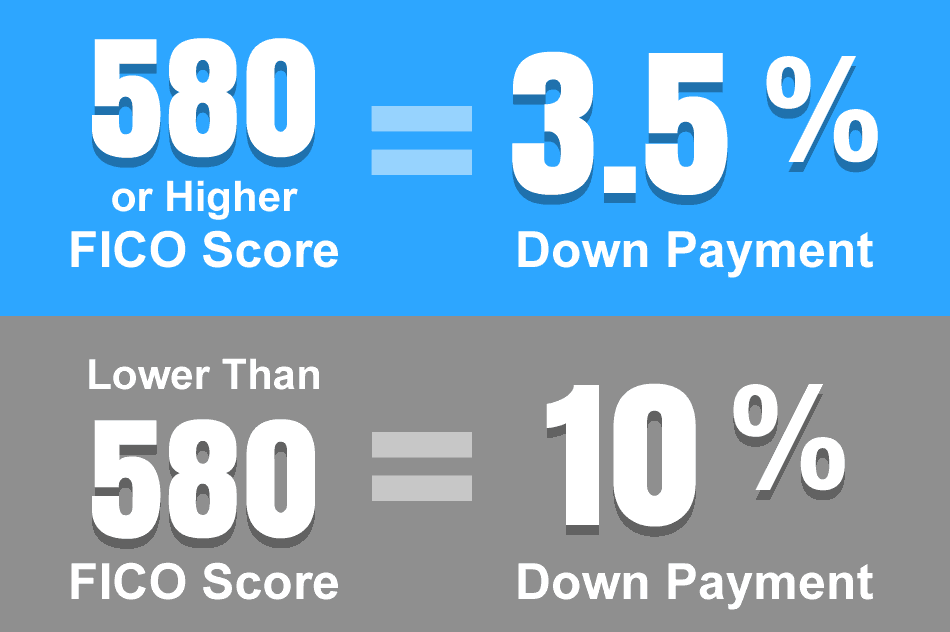

Injury and Illness Calculator. Allowing down payments as low as 35 with a 580 FICO FHA loans are helpful for buyers with limited savings or lower. FHA RefinanceWhile mortgages from the Federal Housing Administration FHA have less stringent down payment requirements unlike conventional loans mortgage insurance premium MIP not to be confused with the additional upfront MIP thats 175 of FHA loan value payments are still required after 20 home equity is reached.

Foreclosure 111214 FHA claim dates was 71215 the 3-year waiting period ends 71318. Foreclosure waiting period is measured from the date of title transfer. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

Occupation title click on the occupation title to view its profile Level Employment. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. A loan term is the duration of the loan given that required minimum payments are made each month.

FHA loan rules in HUD 40001 say that FHA mortgages can never be used for vacation properties timeshares or transient occupancy. 30 years the loan amount and the initial loan-to-value ratio or LTV. FHA minimum credit score.

We do not ask users to bypass their lender. FHA minimum down payment. Streamline Refinance Cash-out Refinance Simple Refinance.

Cost of title insurance and title examination. Your signature will suffice. FHA Title 1 loan requirements.

VA loan closing costs range between 1 and 5 of the total loan amount. According to the rule book. Occupancy is required for both new purchase and FHA cash-out refinance loans.

An FHA insured loan is a US Federal Housing Administration mortgage insurance backed mortgage loan that is provided by an FHA-approved lender. If the foreclosed loan was an FHA loan the 3-year waiting period is based on the date the FHA claim was paid eg. My HomeEquity Builder Loan Amount.

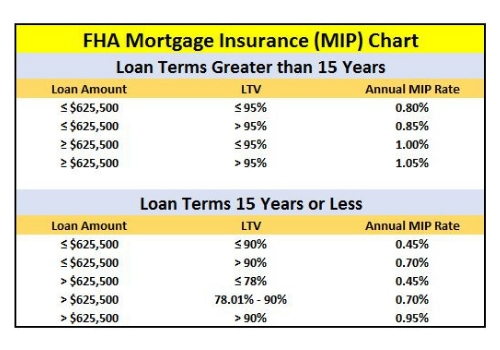

An FHA loan is a mortgage insured by the Federal Housing Administration. 045 percent to 105 percent depending on the loan term 15 years vs. The loan officer will be required to calculate the amount of your financial obligations and compare it to your current income to determine approval eligibility.

FHA loans are designed for low-to. We have spoken directly to licensed lenders that originate these residential loan types in most states and each company has supplied us the guidelines for their products. Base First Loan Amount.

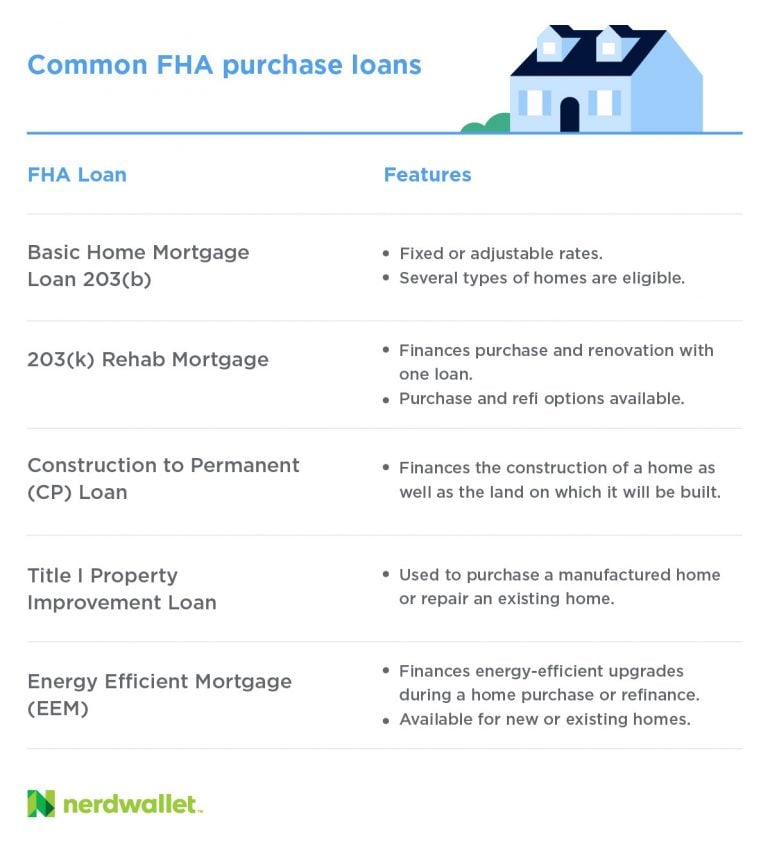

Down payments on a Title II loan can go as low as 35 percent and terms can last as long as 30 years. If youre thinking about applying for an FHA home loan to purchase a house served by a septic system you may have questions about the acceptability of the system your potential new home uses. Document preparation by a third party.

PMI is 05-1 of the loan amount per year PMI is canceled once your mortgage balance reaches 78 Average closing cost. Upfront MIP payment is 175 of the loan amount The annual MIP cost is 045-105 of the loan amount MIP is paid throughout the entire loan. Generally the longer the term the more interest will be accrued over time raising the total cost of the loan for borrowers but reducing the periodic payments.

We do not ask users to surrender or transfer title. We encourage users to contact their lawyers credit counselors lenders and housing counselors. Three 3 years must have elapsed from the time title transferred.

September 6 2022 - When you apply for an FHA mortgage loan your lender is required to make sure you can afford the loan and your current amount of monthly debt. HUD 40001 page 135. And how does the lender calculate this income when its determined that it meets the FHA loan standards in HUD 40001.

Because this type of loan. FHA mortgage insurance protects lenders against losses. For employees with Overtime or Bonus Income the Mortgagee must average the income earned over the previous two years to calculate Effective Income.

Credit Score Requirements as Low as 580. For basic loan options you wont find VA FHA or USDA loans here Ally offers competitive rates and standard lender fees which range from 2 to 5 of the loan. This can be.

FHA loan requirements and guidelines for mortgage insurance lending limits debt to income ratios credit issues and closing costs. CPI Inflation Calculator. The wide range can be attributed to the VA funding fee which is used in VA loans instead of PMI or MIP.

To qualify for an FHA Title 1 loan potential borrowers must meet certain broad requirements. They have historically allowed lower-income Americans to borrow money to purchase a home that they would not otherwise be able to afford. Annual mortgage insurance premium.

Fannie Mae Some lenders offer Fannie Mae mortgages to borrowers who wish to finance a. Upfront FHAMI PremiumVA Funding Fee. Unlike many mortgage programs there are no hard credit score requirements and homeowners with little or no equity can still qualify.

An FHA loan is a mortgage issued by federally qualified lenders and insured by the Federal Housing Administration FHA. Minimum Needed to Meet Downpayment Requirement. We have done extensive research on the FHA Federal Housing Administration and the VA Department of Veterans Affairs One-Time Close Construction loan programs.

An FHA Title 1 loan is a fixed-rate loan used for home improvements repairs and rehab. Total First Loan Amount. However lenders will make sure potential borrowers meet Title 1 loan requirements.

We have published information about FHA appraisal standards for septic systems in the past but since the advent of updated FHA loan guidelines in the form of HUD. The cost of your funding fee ranges from 05 to 36 of the total loan cost depending on a few factors like the type of home youre buying and if youve used VA. Adjustable-rate loans arent offered Loans under 7500 are usually unsecured.

ZIP Loan Amount Applying To Closing Cost.

Fha Loan Calculators

Fha Loan What To Know Nerdwallet

Usda Home Loan Qualification Calculator Freeandclear

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Calculators

Va Mortgage Calculator Calculate Va Loan Payments

Fha Interest Rates Online 52 Off Www Ingeniovirtual Com

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Home Improvement Loan Calculator

Fha Interest Rates Online 52 Off Www Ingeniovirtual Com

Fha Loans How Can I Estimate My Monthly Mortgage Payment

Home Improvement Loans Calculator See Current Local Rates Qualify For An Fha 203k Title 1 Or 2 Home Improvement Loan

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Fha Title 1 Loans What You Need To Know Lendingtree

Fha Loan Calculator

Minimum Credit Scores For Fha Loans