40+ what do you need to get a mortgage loan

Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Updated Rates for Today.

Bridging Loan Eligibility Criteria What Do You Need To Apply

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

. 1180 NW Maple St Suite 300. See The Top Deals From The Best Mortgage Lenders On The Market. Issaquah WA NMLS 2444167.

Web However youll need proof of a high school diploma or GED. If you cannot get a mortgage from a. Web Requirements for Pre-Approval.

Get Instantly Matched With Your Ideal Mortgage Lender. Web decide to approve your mortgage for a lower amount or at a higher interest rate. See if you qualify.

Comparisons Trusted by 55000000. Lenders dont necessarily require your two years of. Ad Dedicated to helping retirees maintain their financial well-being.

Comparisons Trusted by 55000000. Web The first step in applying for a mortgage is completing a standardized form called the Uniform Residential Loan Application. Web Most lenders will require at least a 3-5 percent down payment though youll need to pay ongoing fees for mortgage insurance if you put less than 20 percent down.

Web How much equity do you need for a bridging loan. Web The traditional way to get pre-approved is to schedule an in-person interview with an officer of a bank. Generally lenders will need at least 25 to 40 equity in a property used as security the higher the LTV the.

Comparisons Trusted by 45000000. Ad 10 Best House Loan Lenders Compared Reviewed. If your credit score is below 580.

Forbearance is when your mortgage servicer thats the company that sends your mortgage statement and manages your loan or lender allows you to pause. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Pre-approval meetings are restricted to hours when the bank is.

Only consider your application if you have a large down payment. Web You need a reasonable debt-to-income ratio usually 43 or less You must have been earning a steady income for at least two years Your income must be expected. A Division of American Pacific Mortgage.

Web What do you get with a Physicians Mortgage Loan. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Mortgage pre-approval requires a buyer to complete a mortgage application and provide proof of assets confirmation of income.

Web FHA Loan applicants must have a minimum FICO score of 580 to qualify for the low down payment advantage which is currently at 35. During the preapproval process the lender will look at your financial paperwork. Ad Get Instantly Matched With Your Ideal Mortgage Loan Lender.

Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310. Lock Your Rate Today. Ad Easier Qualification And Low Rates With Government Backed Security.

Save Time Money. Each borrower has to complete this. Youll pay more without a minimum 20 down payment.

Experts continue to encourage buyers to save a down payment of at least 20 before applying for a mortgage. Web Web The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. In most cases youll need at least two years of employment history to qualify for a mortgage.

Web Step 4. Web If you are buying a home you will probably have to take out a mortgage which is a long-term loan to finance a property purchase. Ad 10 Best House Loan Lenders Compared Reviewed.

Compare Rates Save. Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. Ad 2023s Online Mortgage Reviews.

10 Best Mortgage Loans Lenders Compared Reviewed. Were not including any expenses in estimating the income. 100 financing for loan amounts under 850k 2.

Loan amounts up to 1500000. Even without a college degree you can still make a significant amount of money as a loan originator. Require that someone co.

Lock Your Rate Today. Web A ConsumerAffairs nationwide survey found 40 of consumers say they need a personal loan right now showing the damaging effects of inflation. Before you go house-hunting get preapproved for a loan.

Get Instantly Matched With Your Ideal Mortgage Lender. Web To get a loan from a lender to buy property you need a good credit score decent debt-to-income ratio and a handle on how much house you can really afford. Web Key Takeaways.

40 Gov T And.

Mortgage Loan Wikipedia

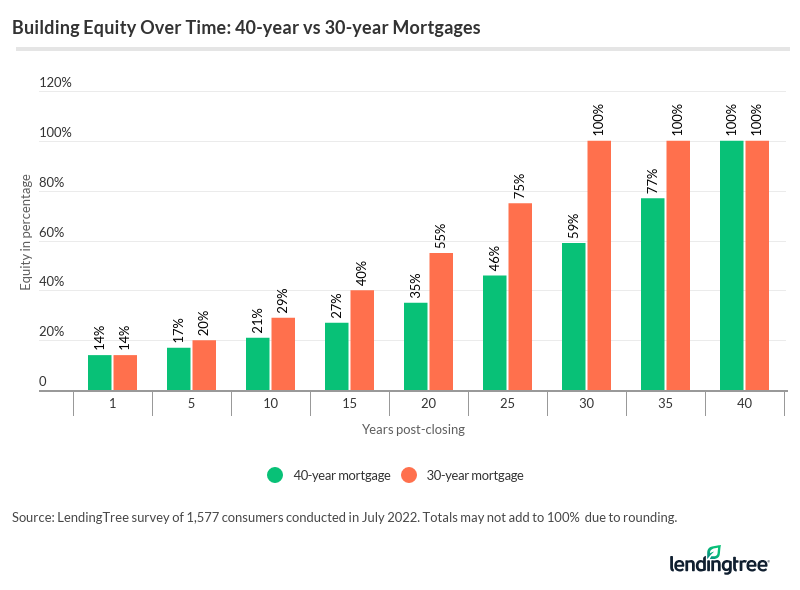

What Is A 40 Year Mortgage Lendingtree

Ent Credit Union Apply For An Ent Mortgage Loan And You Can Lock In Your Rate For 60 Days With Ent S Rate Lock If Rates Decrease You Can Get The Lower

Nmls Safe Act Exam Study Guide Complete Test Prep For Mortgage Loan Originators By Kng Education Audiobook Audible Com

Refinancing Simple Easy Finance

Welcome To Pacific Mortgage Pacific Mortgage

Loan And Mortgage Servicing Solutions Target Group

Can I Get A 40 Year Mortgage Answers Ahead

Become A Mortgage Loan Originator 6 Step Guide

8 Ingredients To Make The Perfect Home Loan

Recommended Net Worth Allocation By Age And Work Experience

Economics Student Proposes A Way To Tax The Rich His Wealthly Professor Gets Mad R Selfawarewolves

How Much Should I Have Saved In My 401k By Age

How To Get A 40 Year Mortgage Rates Lenders More

P Mortgages What Is A P Mortgage And Is It The Best Choice For Buying A Property Should I Choose P H Or Fixed Rate Mortgages When Buying A Property

What Is Fannie Mae Purpose Eligibility Limits Programs

40 Things Every 40 Should Know About Buying A Home Gobankingrates